Arch @ Bitcoin2024: From Nashville to the World

What a week for the Bitcoin community. In just the span of a few days, two of the three remaining U.S. presidential candidates announced…

What a week for the Bitcoin community. In just the span of a few days, two of the three remaining U.S. presidential candidates announced plans to enact strategic federal BTC reserves if elected, while a U.S. senator declared that Bitcoin was “the solution” and “our Louisiana Purchase moment.”

The main stage was, safe to say, a bullish space. But here at Arch, what excited us most was more than just the star-studded conference and the slate of policy heavyweights that showed up for Bitcoin 2024 Nashville.

No, what invigorated us mostwas the wide range of builders who showed up — true Bitcoin believers who are increasingly bringing innovation onto the world’s largest and most valuable blockchain.

We were proud to be a participant and leader in many of these conversations, with our founder Matt Mudano speaking at a number of events.

Here’s our recap of what went down, plus some insights.

“The Landscape of Bitcoin Layers” at UTXO Management #alphaday

We were excited to head off our Bitcoin 2024 experience with some amazing Bitcoin luminaries, as Matt spoke on a panel with Janusz of Bitcoin Layers and Hakan Sezikli of BEVM.

With the advent of Ordinals and Runes, the emergence of Bitcoin Layer 2s has been an exciting development in the space. However, at Arch, we believe it’s important to first start by asking what Bitcoin is lacking — and that is a native VM, similar to the types seen on Ethereum and Solana.

“We’re not trying to shove a square peg into a round hole,” Matt said, pointing to the fact that Arch is making a specific trade-off — accepting the computational limitations of building directly on Bitcoin in return for the ability to offer bridgeless execution that can capitalize on the full liquidity and security of Bitcoin as a trillion-dollar plus asset.

He went on to note that while some want to move DeFi onto Bitcoin Layer 2s, similar EVM options have existed for a while now with little adoption — roughly $10 million is invested in “wrapped” or bridged BTC assets, less than 1% of the total BTC market cap.

“Ultimately, Bitcoin voters have voted with their keys and money to say that they don’t want additional trust assumptions.”

Fun & Games at the Bitcoin Barcade

Thursday night was a great chance for Arch to join Magic Eden in bringing together the Bitcoin community at Nashville Underground, where attendees enjoyed drinks, food, a live DJ, arcade games, bowling, and mechanical bull rides … not to mention an epic rooftop view over Broadway.

More than 1,335 signed up for the epic night, with the line often rounding the block with excited Bitcoiners ready to join the fun. And while Bitcoin has long had a devoted fellowing, it was thrilling to see how the introduction of Ordinals theory in late 2022 has led to so many founders creating innovative projects to shape a new era of Bitcoin programmability — a major step for the promise of decentralized finance and community building.

“Do EVM BTC L2’s Make Sense” with Friends of Bitcoin

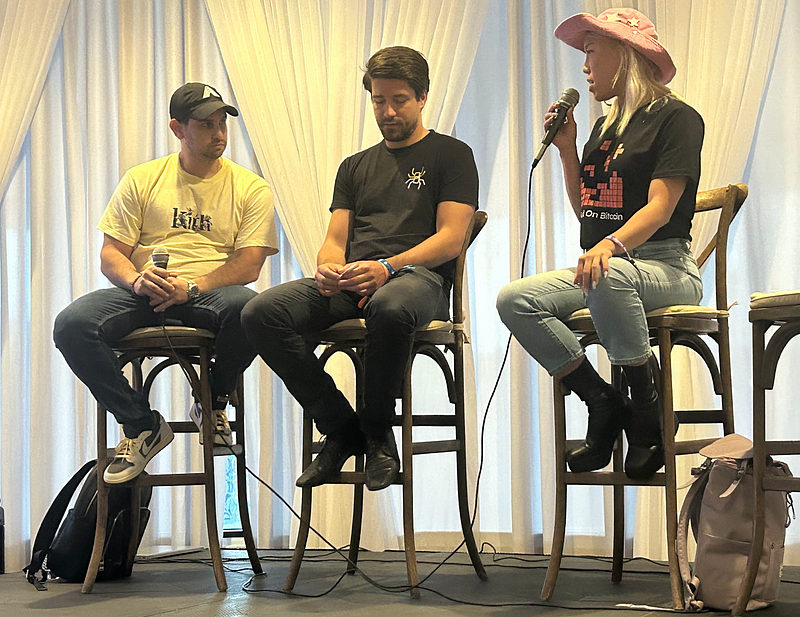

The team also joined an intimate gathering at the Horton Building hosted by friendsofbitcoin.xyz, with Matt speaking on a panel with Zhixi Zhang of BOB (Build on Bitcoin) and Willem Schroé, founder of Botanix Labs.

“Nothing is perfect,” as Zhang said. “If there wasn’t a need for any optimization, then there wouldn’t be any debate on it.”

Zhang noted how Layer 2s can introduce real challenges for Bitcoiners, including the risks of having a centralized sequencer — a problem BOB works to address by bringing miners into the consensus mechanism and allowing them to challenge the state of the chain if the sequencer is corrupted.

Schroé noted the many downsides of the EVM. “It’s really bad. It’s not secure at all. There’s so much wrong with it,” from recursive contract calls to high gas fees.” And yet … “it doesn’t really matter,” he argued, just as many people use a Windows Operating System even when it isn’t an optimal OS for many functions.

Why? Because it has the biggest distribution.

Distribution is key for Schroé, which is why Botanix is building its Bitcoin L2 in a way that makes it possible for developers to copy paste their smart contract infrastructure from the EVM and deploy it into Botanix with little friction.

We believe there is plenty of room in the Bitcoin space for L2s like Botanix and BOB, with each network optimizing for different goals. Our hypothesis is that, beneath those layers, there must be an execution platform that allows for programmability built directly on Bitcoin.

This bridgeless platform, being built by Arch, can serve as a secure, trust-minimized way for Bitcoiners to access DeFi and other services without having to take on additional risk with their valuable BTC assets.

“Much like Ethereum, you’re going to have ways of addressing scalability and ways of tapping into the liquidity that’s on Layer 1.”

“The difference in the way we set up our design, is that with your Layer 1 Bitcoin transaction … you can actually invoke smart contracts on Layer 1 without integration risk. That’s very different from Layer 2s, where the very first step in order to get to that programmability is bridging.”

“The New Frontiers in Bitcoin Scaling”with the #BitcoinBuilders

We capped off our speaking appearances in Nashville with a fantastic conversation with Yanju Chen, chief scientist at Nubit, and Esad Yusuf Atik, Co-Creator & CTO, Citrea.

The TLDR;

- Rollups are definitely going to be needed to scale. But before solving for that, we believe in building the core base-layer execution platform for Bitcoin. What really matters in design choice is the various trust assumptions and threshold signatures, and the ways you can reach consensus in a trust-minimized way

- MultiSigs have gotten a bad rap, and it makes sense why. In many people’s minds, MultiSig = Centralized. In reality though, there are a variety of different design choices and utilizations you can make to make Bitcoin execution much more trusted and decentralized, depending on what architecture you’re actually using. To build Arch, we’re creating a novel combination of FROST + ROAST particular architecture (you can read more about that here).

- Everything that’s been tried on Ethereum will be tried on Bitcoin one day. We are huge believers in Bitcon programmability, and once the infrastructure is there, we expect to see significant programs come online, beginning with the pillars of DeFi to prediction markets and more degen protocols

- Fragmented liquidity is bad, but what’s worse is dormant liquidity. Despite the $1T+ market cap of Bitcoin, a vast majority of that value isn’t being fully tapped into … which is why we need to create an avenue for programmability that doesn’t require taking on trust assumptions that Bitcoiners have already proven not to want.

Join us, as we create the next frontier for Bitcoin!

Our multi-phased testnet is underway.

Sign up to participate and earn rewards for building on Arch.

You can also follow us at: