Structured Finance on Bitcoin: The Idle Capital Problem

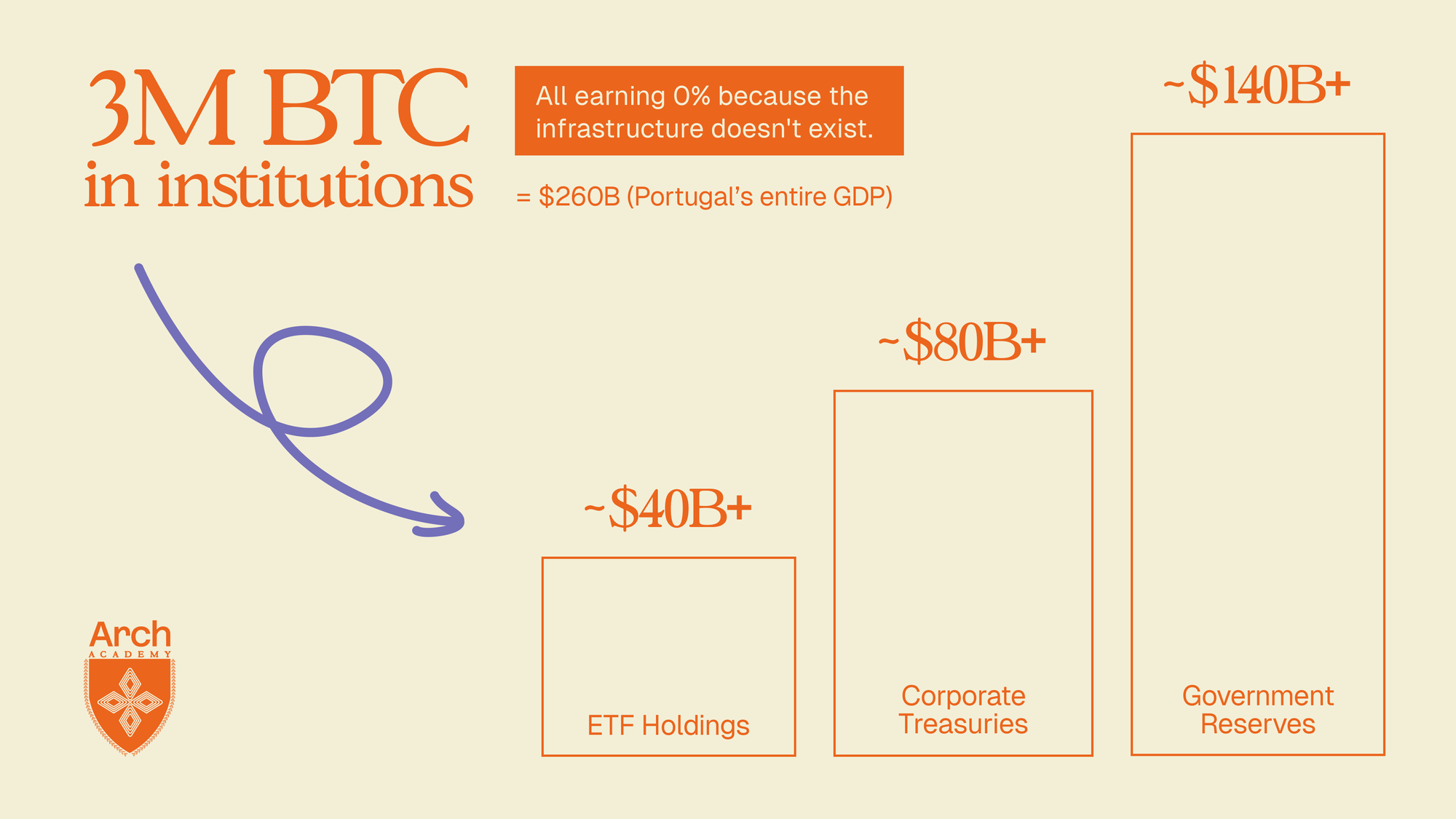

260 billion dollars in institutional Bitcoin earns nothing.

That's 3 million BTC spread across exchange-traded funds, corporate treasuries, and government reserves. More capital than Portugal's GDP sitting static, producing zero return. Not because institutions lack interest in yield, but because they lack the infrastructure to deploy capital safely while maintaining the custody model and settlement assurances they require.

The scale matters. At this magnitude, inactivity represents a market structure problem. Capital that could participate in collateralized lending, structured credit facilities, or programmatic yield strategies instead remains dormant on balance sheets.

The question institutional allocators keep asking is straightforward: how do we put Bitcoin to work without introducing unacceptable risk?

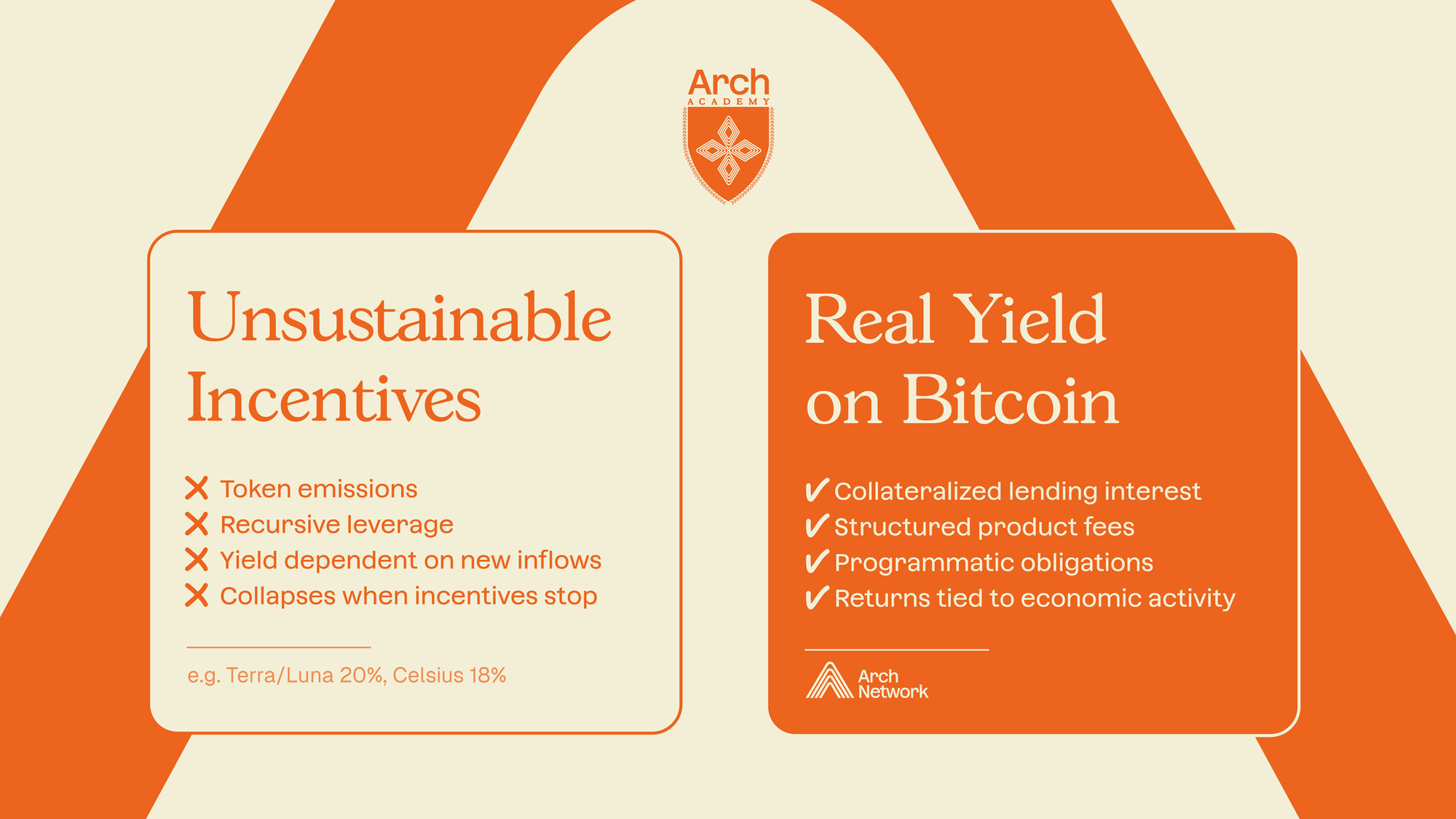

Traditional answers have failed. Most structured finance activity touching Bitcoin still happens off-chain or through platforms that cannot inherit Bitcoin's settlement properties. Credit arrangements depend on custodians. Structured exposures reference Bitcoin price but the underlying BTC sits in systems incapable of coordinating financial logic programmatically. Wrapping assets or bridging to other chains fragments liquidity and introduces custody assumptions institutions explicitly avoid.

This reflects a fundamental infrastructure gap. Bitcoin offers deep liquidity and proven settlement, yet the rails required to use BTC in programmable financial workflows have been missing.

What Productive Bitcoin Requires

Bitcoin itself is the strongest real-world asset in crypto. Mined with electricity, scarce by design, proven over 15 years as reliable digital collateral. As traditional assets move onchain, they need settlement against an asset with exactly these properties. Bitcoin stands apart.

Productive Bitcoin means BTC deployed in financial workflows that generate returns while remaining on the base layer. Not wrapped. Not bridged into synthetic formats. Supporting collateralized lending, structured payouts, programmatic yield enforced directly onchain.

Protocols building on Bitcoin today manage collateral and position logic that must be enforced predictably. Each depends on the same requirement: systems that can evaluate financial logic and settle results on Bitcoin.

For this activity to scale, Bitcoin needs an execution environment capable of processing instructions, tracking state, ensuring alignment between application actions and base layer reality. The separation between storage and use becomes clear. Idle BTC sits on balance sheets. Productive BTC participates in structured workflows where obligations, collateral adjustments, and payouts are enforced programmatically and visible onchain.

This shift requires specific technical capabilities.

The Execution-Settlement Model

Bitcoin cannot run complex financial logic natively. Moving BTC to other chains means bridges, wrappers, custody risk. None of these work for institutional allocators with fiduciary obligations and risk committees.

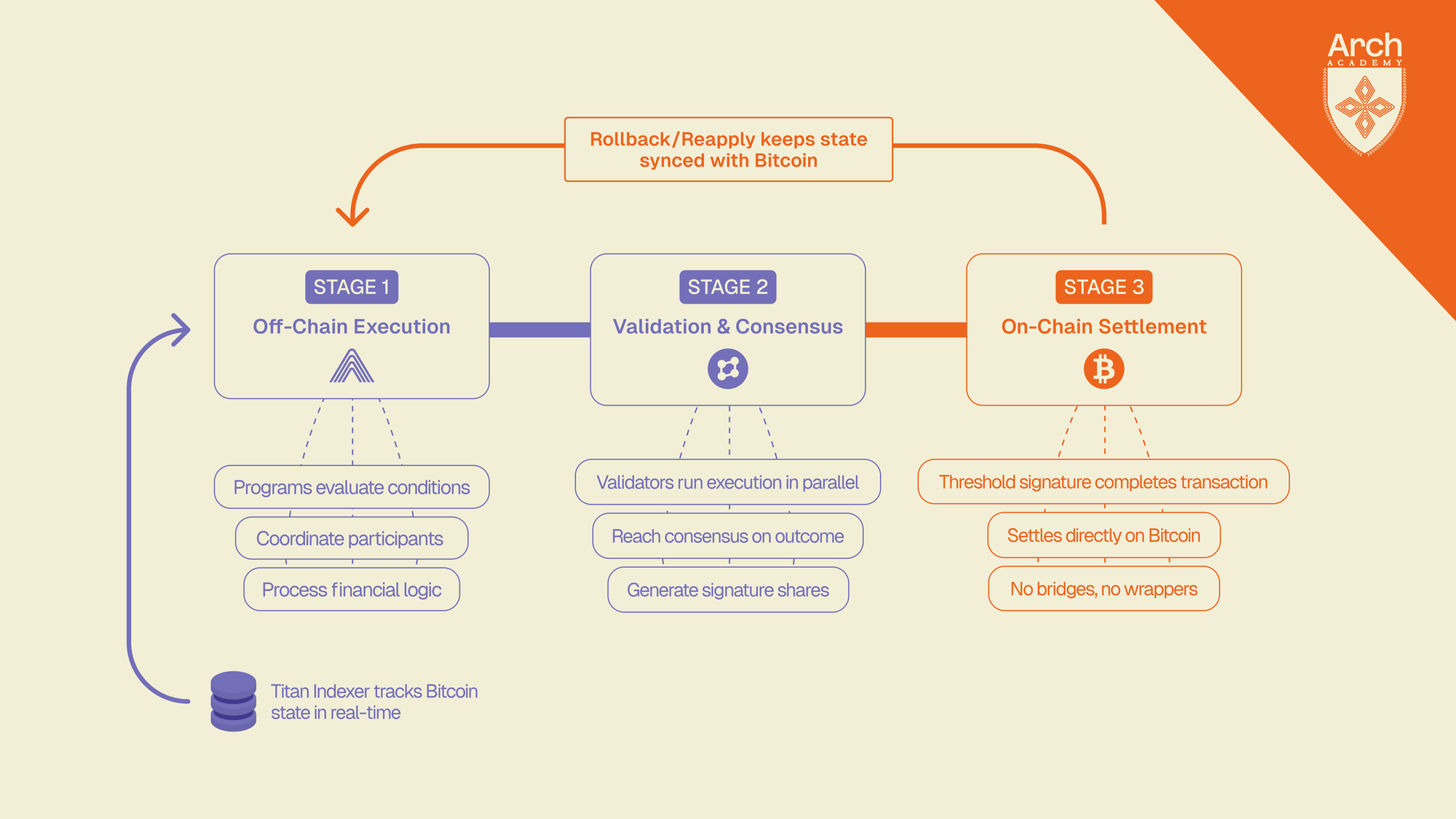

Arch solves this through a model where execution happens off-chain while settlement stays on Bitcoin. No bridges. No wrapped BTC. Just native Bitcoin used in programmable workflows.

The ArchVM processes financial logic in a controlled environment that can enforce rules, update positions, determine outcomes before anything finalizes on Bitcoin. Programs define how collateral is posted, how credit limits calculate, how obligations update, how structured payouts trigger. The execution environment must stay aligned with Bitcoin continuously.

Arch achieves this through the Titan indexer and a directed acyclic graph tracking state transitions. Titan indexes Bitcoin at the mempool level, providing real-time visibility into transaction status. When a transaction relevant to a program is replaced or reorganized, Arch uses rollback and reapply mechanisms to keep application state consistent with the base layer.

Once logic processes and outcomes are clear, settlement moves to Bitcoin. Validators who evaluated the program hold key shares in a FROST plus ROAST threshold signature scheme over a Bitcoin address. This produces standard Bitcoin transactions reflecting program results without wrapping assets or depending on separate consensus layers.

The combination keeps Bitcoin at the center. Lending, credit formation, structured payouts coordinate through programmatic logic while final settlement uses real BTC on the base layer. The model eliminates synthetic assets, eliminates bridges, keeps trust anchored to Bitcoin.

Developers gain the environment required to build financial applications operating at execution speed while settling directly on Bitcoin. Institutions gain infrastructure that meets their requirements for security, settlement assurances, and liquidity depth.

Structured Finance Primitives on Bitcoin

Financial activity on Bitcoin becomes practical when programs can define how collateral posts, how credit extends, how payouts trigger while keeping settlement anchored to the base layer.

Collateral forms the foundation. Protocols building on Arch use BTC or other supported UTXO assets as posted collateral inside programmatic workflows. Programs define how collateral locks, how value tracks, what conditions require adjustments or liquidation. Each step depends on the execution environment enforcing rules before settlement.

Credit sits above collateral. Credit formation requires predictable enforcement of obligations, visibility into position updates, coordination among multiple participants. Through the ArchVM, programs track loan origination, interest accrual, repayment schedule evolution. Settlement expresses as standard Bitcoin transactions signed through the FROST plus ROAST threshold scheme, so credit itself stays tied to BTC rather than synthetic assets.

Structured products extend these mechanics further. Volatility products can define payouts based on Bitcoin price movement. Other applications use programmatic logic to manage position states for Runes and Ordinals or coordinate multi-step actions depending on conditions evaluated reliably.

For all categories, alignment with Bitcoin is essential. Arch uses the Titan indexer and directed acyclic graph of state transitions to track Bitcoin activity in real time. Rollback and reapply methods keep program state consistent with the base layer when transactions change. This ensures collateral updates, credit events, structured payouts determine only after the execution environment reflects Bitcoin's actual state.

Real Yield Without Bridges

Autara Finance demonstrates how these primitives translate to operational money markets. Built on the ArchVM, Autara is a Bitcoin lending protocol where users supply BTC and supported assets to earn interest or borrow instantly using collateral.

Unlike pooled lending protocols where risk propagates across all assets, Autara uses isolated pools. Each asset segregates in its own pool, ensuring exploits, oracle malfunctions, or liquidation delays remain fully contained. Risk doesn't leak across markets. This architecture matters for institutional capital allocators who need granular control over risk exposure.

Users access lending and borrowing from their Bitcoin wallets. Collateral management happens programmatically through the ArchVM. Dynamic liquidation mechanisms incentivize rapid collateral resolution to safeguard protocol solvency while minimizing excess losses for borrowers.

Autara integrates Chaos Price Oracles for institutional-grade price feeds with sub-second latency. Market creators configure oracle stacks tailored to their risk appetite, selecting aggregation methods and redundancy layers ensuring accurate, resilient pricing. This oracle-agnostic approach allows optimization for specific market requirements rather than one-size-fits-all solutions.

Returns come from identifiable financial activity. Lenders earn interest from borrowers who unlock liquidity from Bitcoin without selling. Borrowers access capital with risk exposure limited to exactly the assets they choose. The yield is real, not token incentives masking lack of sustainable economics.

For institutions evaluating Bitcoin DeFi opportunities, Autara shows what becomes possible with proper infrastructure. Supply and borrow markets on native Bitcoin. Isolated risk architecture. Institutional-grade oracles. Dynamic liquidation protecting protocol solvency. All settling directly on Bitcoin without custody assumptions traditional finance organizations cannot accept.

From Static Holdings to Active Deployment

The pieces now connect. Large institutional BTC holdings remain unused because coordinated financial activity while keeping settlement on Bitcoin was impossible. Execution environments were missing. Tools to express financial outcomes as standard Bitcoin transactions didn't exist.

A purpose-built execution environment changes that landscape. Programs evaluate conditions, coordinate participants, enforce rules before settlement. Application logic connects to Bitcoin's UTXO model instead of relying on wrapped assets or external systems. The structure needed for lending, credit formation, structured payouts, collateral management gains direct onchain expression.

When these capabilities align, economics shift. Idle BTC can participate in processes where obligations, collateral updates, payouts are enforced predictably. Capital moves from passive storage to active use in credit markets, collateral workflows, structured products. Institutions deploy capital through structures operating within Bitcoin's settlement boundaries while maintaining risk controls traditional finance requires.

Protocols building on Arch demonstrate this across credit markets, collateralized positions, programmatic products linked to Bitcoin. The infrastructure is operational. Capital has clear pathways to participate in programmable, enforceable workflows anchored to the base layer.

Structured finance on Bitcoin is becoming part of the operational landscape. The $260 billion idle capital problem has a solution. Institutions can finally put Bitcoin to work natively without sacrificing security or liquidity depth. The question is no longer whether Bitcoin can support institutional-grade structured finance, but which institutions will move first to capture the opportunity.

Learn more about Arch Network's execution environment and how developers are building Bitcoin-native financial infrastructure at docs.arch.network.