The BTC DeFi Surge: Arch Releases Landmark Survey of 125+ Top Builders

The Bitcoin economy is experiencing a seismic shift, rapidly transitioning from the world's hardest currency to its most powerful programmable asset.

That's the takeaway from a landmark Arch survey of 125 builders, investors, and users leading an explosion in Bitcoin DeFi, which shows a surge from $304 million to more than $7 billion in TVL since January 2024.

That increase is still a fraction of Bitcoin DeFi's long-term potential, as recent inflows have led to BTC hitting all-time-highs and a $2.3T+ market cap.

Key takeaways from the Arch report underscore the latent opportunity in the Bitcoin ecosystem, as well as its potential to expand as underlying tech and security infrastructure improve.

5 Key Takeaways

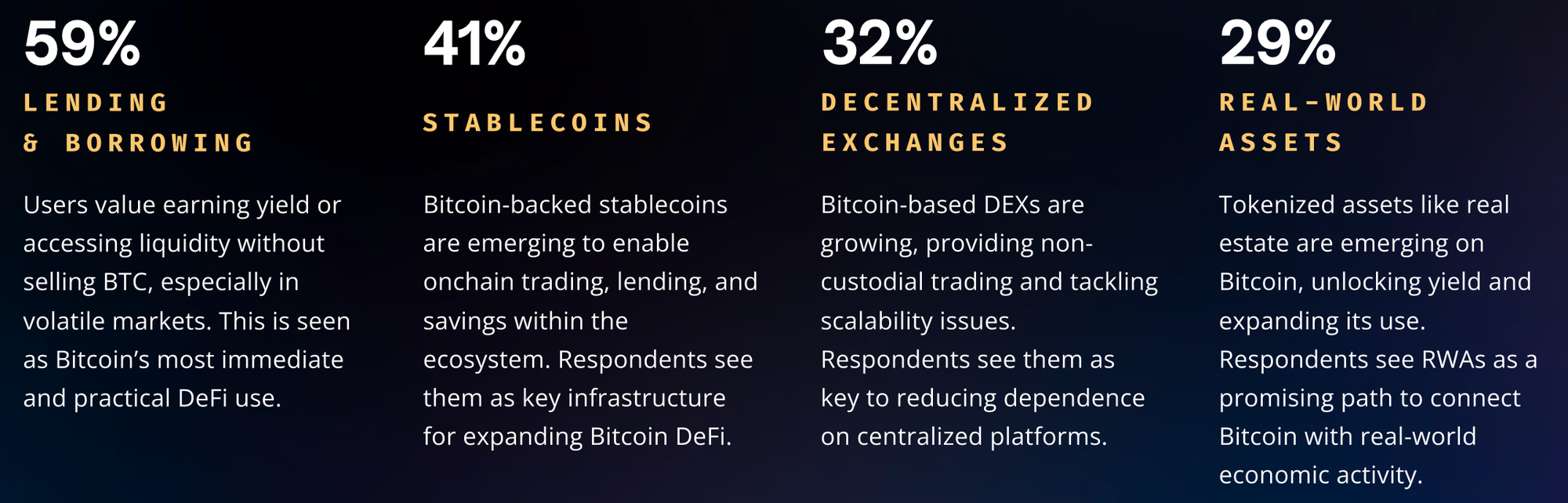

Takeaway #1: Major DeFi use cases are emerging on Bitcoin, with lending apps leading the way for Bitcoin builders.

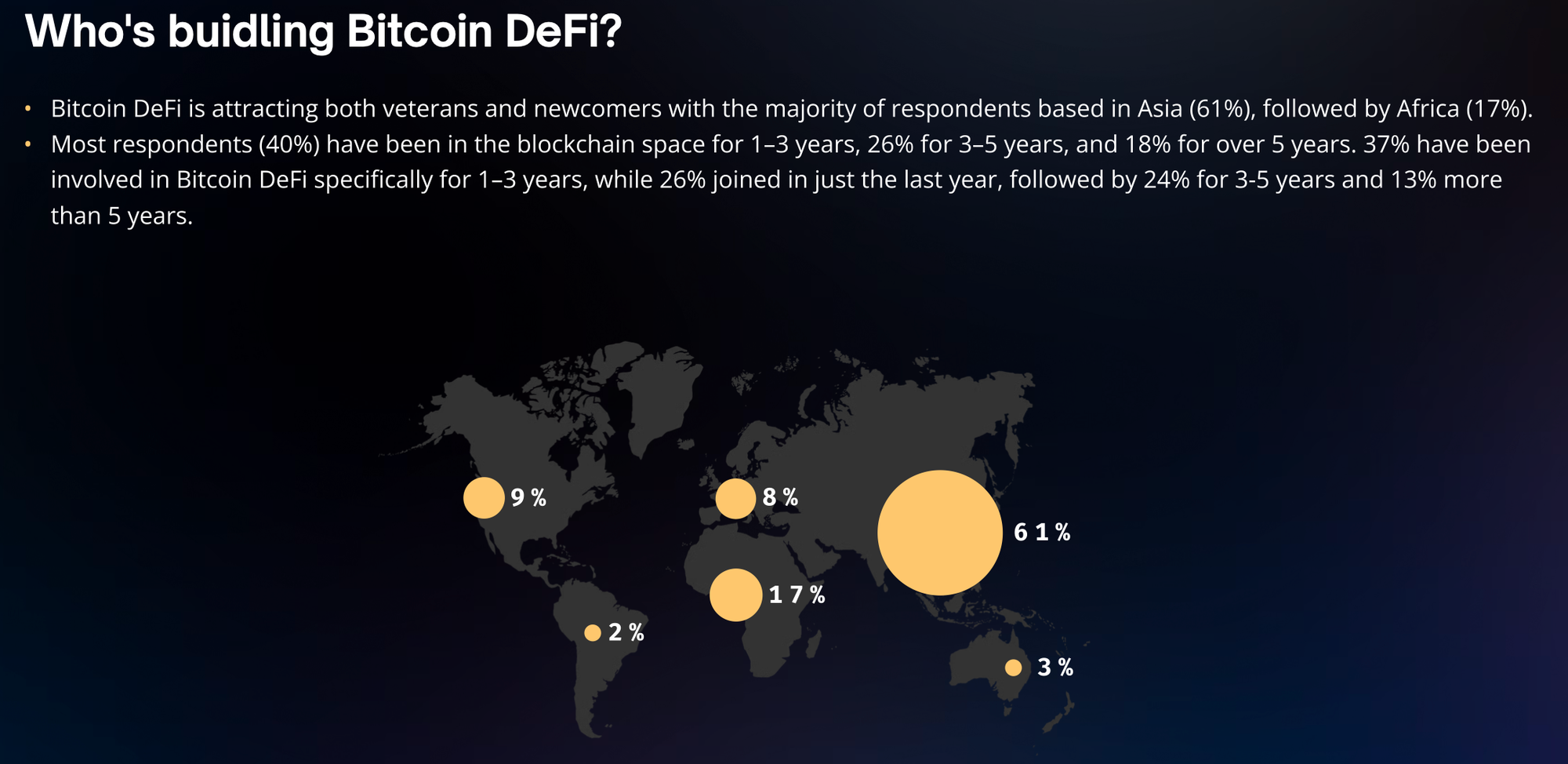

Takeaway #2: Asia is a major market for Bitcoin DeFi, and a quarter of builders just started working in the space this year

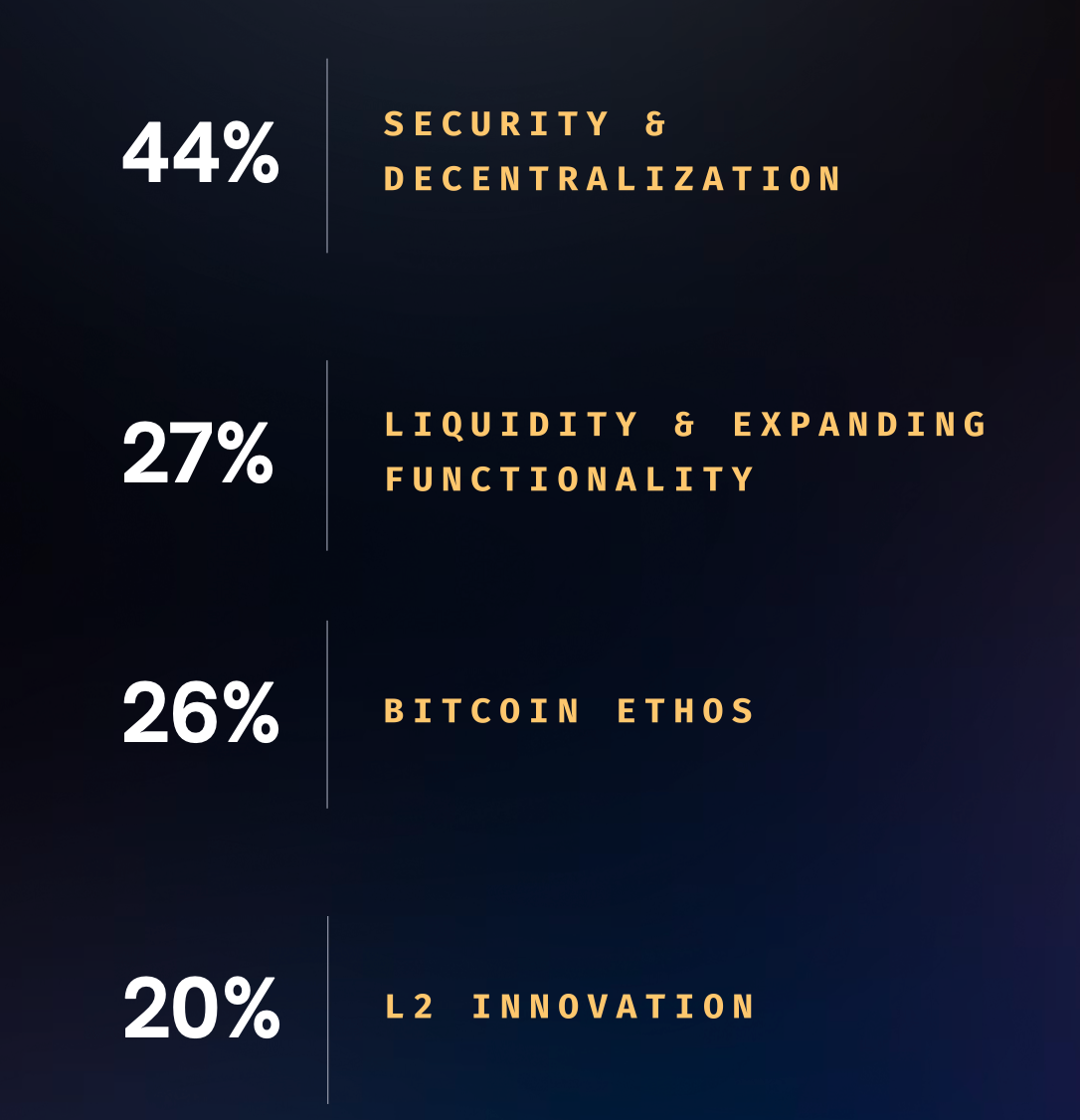

Takeaway #3: DeFi builders choose Bitcoin for its security and decentralization most of all, followed by its liquidity

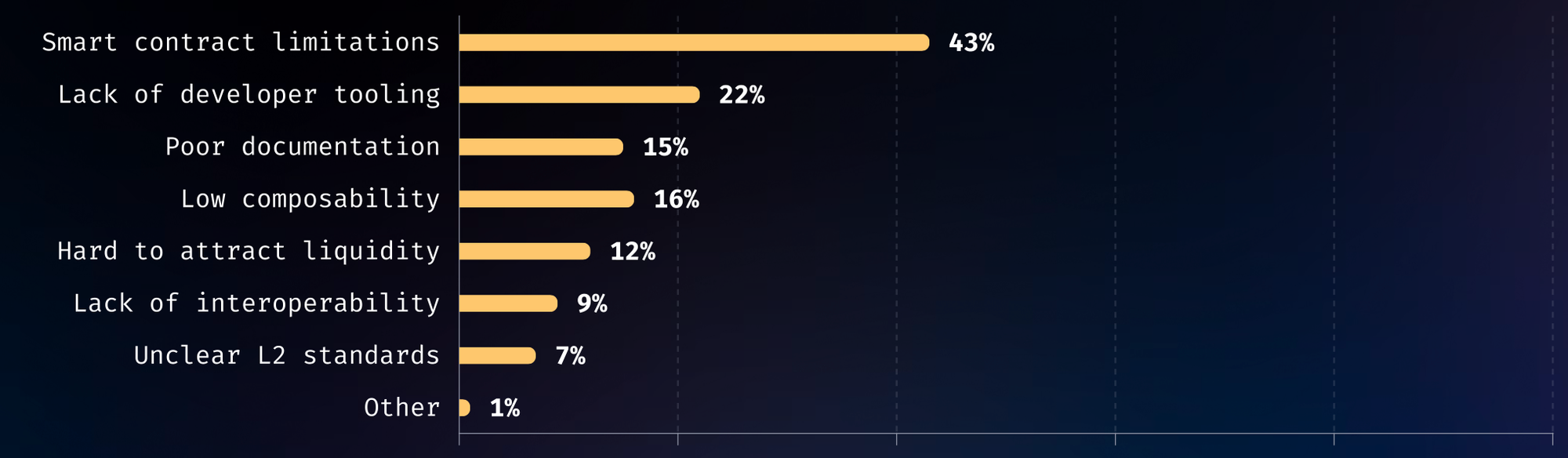

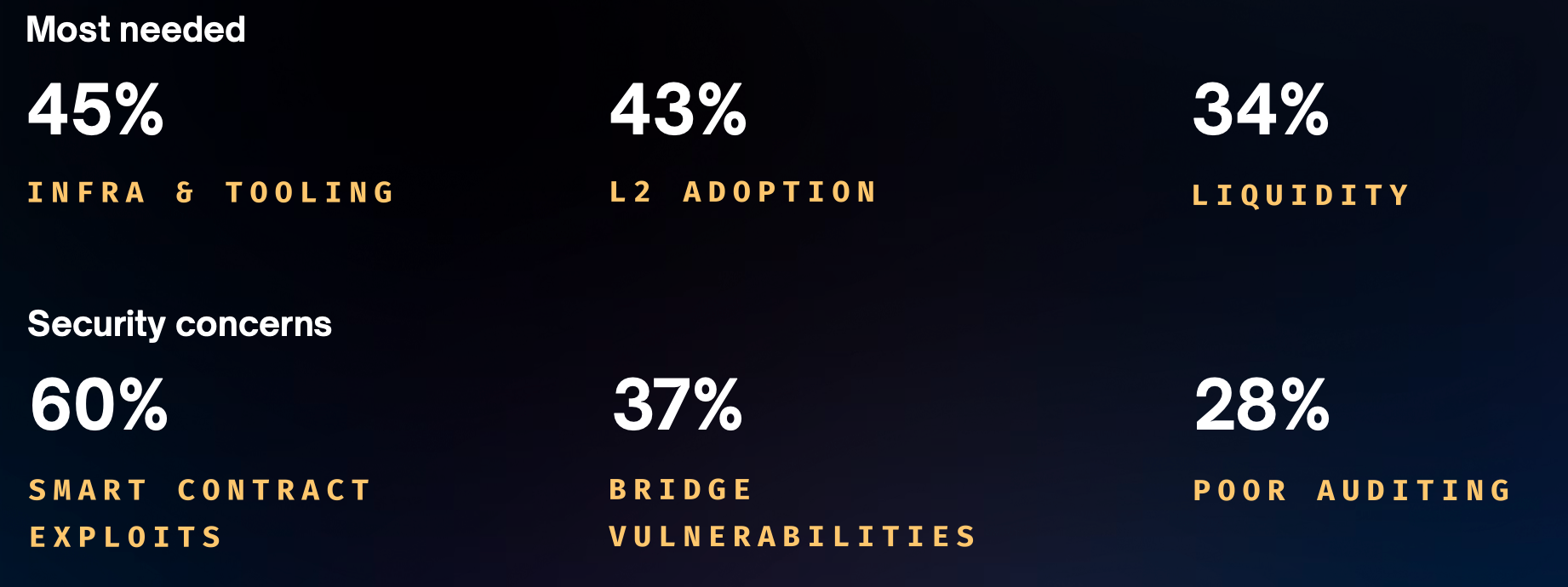

Takeaway #4: Builders continue to build despite significant obstacles, with solving infrastructure and security challenges representing a major opportunity for Bitcoin DeFi growth.

Takeaway #5: Investors remain bullish on BTC DeFi, recognizing its potential to un-tap the new Bitcoin economy.

"Ethereum and Solana have led in experimentation and innovation, but Bitcoin is where the deepest conviction and capital live," says Shahan Khoshafian, General Partner at DPI Capital, which made headlines for going "all in" on Arch apps earlier this year.

"With Arch Network, Bitcoin is getting its application layer. Native smart contracts, no bridges, and full composability built on Bitcoin's security layer."

Similar conviction led Pantera, which launched the first U.S. cryptocurrency fund over a decade ago, to lead Arch's $13M Series A round in April.

"Bitcoin DeFi requires a unique custody construction since it has sizable demand from institutions that only use qualified custodians such as Anchorage and Fordefi to store or trade," wrote Ishanee Nagpurkar, while announcing Pantera's investment.

"It’s been great to see the Arch team working with QCs so early on behalf of Arch developers — helping them cross the chasm for distribution in the future."

Read the full report:

How Arch is unlocking the Bitcoin economy

Bitcoiners have made it clear that they will not compromise decentralization or accept bridge risk in order to participate in DeFi.

Arch has been purpose-built to provide execution on the base layer of Bitcoin, without forcing users to move their assets to some other chain.

That decision has unlocked a wave of institutional and retail support as the network moves closer to mainnet, with the most BTC-native yield opportunities available on the horizon.

Want to build with us?

- Check out the Arch Book

- Apply through our Request for Startups

- Reach out over the Discord